Why Collateral Matters in Used Auto Loans – Understanding the Three C’s

🚗 More Than Just a Credit Score: Why Collateral Counts in Your Auto Loan

If you've been seeing Credit Karma commercials or checking your credit score online and thinking, "That's all I need to get approved," you're not alone. But here's the truth - your credit score is only one piece of the puzzle. As I write this article, I'm reminded of something a good friend and longtime customer once told me. He spent years in the retail banking world in Randolph, Vermont, and would often say, "Lending is all about the three C's - don't forget it." It was a simple concept, and it still rings true today. When lenders review your auto loan application, they're looking at three key C's - and one of the most important is Collateral, provided the other two are not completely outside the bank's underwriting guidelines.

At Upper Valley Auto Mart in White River Junction, we've helped hundreds of customers who didn't think they could get approved. The secret? Understanding how to work with the lender - not against them.

🔍 The Three C's of Car Loans

Most lenders use these three C's to evaluate any used car loan - and understanding how each one works can help you better prepare for success.

1. Credit

Your credit score is essentially a report card on how well you've handled borrowing money. It's based primarily on your payment history - did you make payments on time, or did you fall behind?

The three major credit bureaus - Equifax®, TransUnion®, and Experian® - use a scoring model developed by the Fair Isaac Corporation (FICO®). The higher your score, the better you appear to lenders. While the scores may differ slightly between bureaus, that's usually because they have different information on file. Most lenders in the auto finance world use FICO® Scores to make their decisions - not the other types of scores you might see online.

At the end of the day, a "good" credit score means you've historically paid back your debts on time and managed your borrowing better than the average person. But remember - even if your credit isn't perfect, you still have options, especially when you understand the next two C's.

2. Capacity

Capacity is just a lender's way of asking: "Can you afford this loan?"

They'll look at, your monthly income, how long you've been at your job and other debts you're paying each month (like housing costs, credit cards, student loans, etc.). This all goes into calculating something called debt-to-income ratio (DTI) - a comparison of your income to your monthly obligations. The lower your DTI, the more breathing room lenders feel you have in your budget to take on a car payment.

Even with average or poor credit, strong capacity can be a huge boost in getting approved.

3. Collateral

Collateral is the vehicle you're buying - and the part of the loan that lenders see as "insurance." If something goes wrong and you can't pay, they need to know they can recover their money by reselling the car.

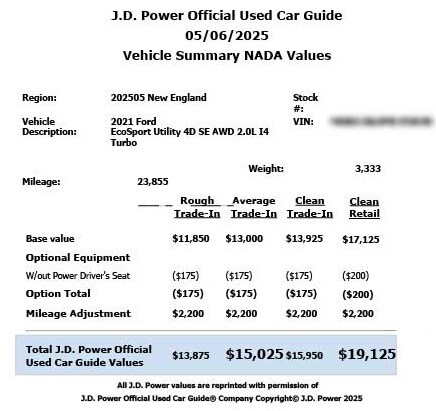

That's why they pay such close attention to Loan-to-Value (LTV) ratios. Some lenders base this value on retail book value, while others use trade-in value or a loan value. In most of the country that value is based off from JD Power's Guidebook, but Kelly Blue Book is used predominantly on the west coast. If the numbers don't line up, they may decline the loan or ask for a larger down payment.

The good news? With the right dealership - and the right vehicle selection - you can make the collateral work in your favor.

💰 What Is Collateral and Why Should You Care?

Collateral is just a fancy word for the vehicle you're financing. The lender sees this car as their "backup plan." If you stop making payments, they need to know they can get their money back by repossessing and selling the car.

To do that, they focus on something called the Loan-to-Value ratio (LTV) - how much they're loaning compared to what the car is worth. Too high of an LTV? You might get declined.

📉 Not All Vehicles Are Created Equal (At Least Not to Lenders)

This is where things get interesting and many car purchases fall apart. You'd think a high-demand brand like Toyota or Honda would be the perfect choice. But here's the catch: many of these cars sell at wholesale prices that are only a few hundred dollars below their retail value. That makes it hard for a lender to "see room" in the deal.

On the flip side, vehicles like a used Ford EcoSport or Jeep Cherokee often sell in the wholesale market between dealers for $2,000 to $4,000 under retail book value - allowing the dealer to structure a car deal giving the lender a much more favorable LTV. Making your car deal much more likely to get an approval.

Lenders are very rigid when applying LTV values to car loans. Depending upon other factors, the lender will usually have a maximum advance over one of the book values used by JD Power. For excellent credit that number might be 125% of Retail book value, but for a customer with past credit issues, the number might be only 80% of retail book value.

🧾 Real-Life Inventory Examples: Picking the Right Car

Here's a quick example based on vehicles we have look at this week:

2023 Toyota Tacoma TRD Sport Crew 4x4

Retail Book Value: $40,600.00

Wholesale Value: $39,200.00

LTV: Too tight - tough to get approved

2021 Ford EcoSport SE AWD

Retail Book Value: $19,125.00

Wholesale Value: $16,100.00

LTV: Great! Plenty of room for the lender

This is where our team steps in to help. We don't just pick a car - we structure a loan to match the lender's algorithm. With the Ford, our team has room to sell you the vehicle under the retail book value and increase your chances of getting a yes. We will know the vehicles we have in inventory that look good to a bank when they are looking for a certain percentage of retail value.

🔁 What If You're "Upside Down" on Your Trade?

Do you have a current car loan where you owe more than your car is worth? You're not alone. That's called negative equity, and it can affect your loan approval too.

We specialize in helping customers with negative equity. Sometimes, we find vehicles where the equity gap can be "buried" in a favorable loan. Other times, we'll suggest a down payment or help you switch models to bring that LTV back in line.

It's not always about saying "yes" - it's about structuring the loan the right way to get the approval for you.

🧠 Experience Matters: Why Upper Valley Auto Mart Gets It Done

Our team works with multiple lenders, each with their own rules about collateral, income, and credit. Some use retail book values, others use loan or trade-in values. Some want lower miles. Some allow older cars.

We know who to send your app to. And we know how to match the vehicle, the credit profile, and the loan structure to make approvals happen.

We've helped customers with:

- Past bankruptcies

- Late payments

- Medical collections

- No credit at all

💡 Final Thoughts: Make the Collateral Work for You

Collateral is just as important as credit and income. Choosing the right car - not just the car you want - could be the game-changer that gets you into your next ride. Hearing Your Approved vs. Sorry.

📲 Ready to Make a Smart Move?

Need help? Come see us in White River Junction. Let's find the car - and the loan - that works for you.

Published May 06, 2025

Published May 06, 2025