Paying Cash vs Financing with an Auto Loan

Which is Best for Your Used Car Purchase in Vermont?

Paying Cash for Your Vehicle

Paying cash for your vehicle might seem like the most straightforward choice. After all, there are no monthly payments or interest rates to worry about. But is it the right choice for you? Let's take a closer look at the pros and cons.

Pros of Paying Cash:

No Interest Payments

One of the most appealing aspects of paying cash is avoiding interest payments. Unlike financing, where you end up paying more than the car's purchase price due to interest, paying cash allows you to buy the car outright without any added costs.Full Ownership

When you pay cash, the car is yours immediately. There are no liens, and you won't have to worry about monthly obligations or the risk of repossession if financial difficulties arise.

Cons of Paying Cash:

Depleted Savings

Paying for a vehicle in cash can significantly reduce your savings. If you spend $20,000 on a car, that's $20,000 less in your emergency fund or savings account. This could limit your ability to handle unexpected expenses, such as medical bills, home repairs, or even future vehicle maintenance.Opportunity Cost

Using a large chunk of your savings to buy a car means you might be missing out on other investment opportunities. For example, if you invested that money in the stock market or a high-yield savings account, you could potentially earn more than the interest you'd pay on an auto loan.Limited Liquidity

Paying cash ties up a lot of money in an asset that depreciates. Cars lose value over time, so spending all your savings on a vehicle could limit your financial flexibility in the future.

While paying cash might feel good in the moment, it's essential to consider how it impacts your overall financial stability. That's where financing comes in as a flexible alternative.

Financing with an Auto Loan

Financing a used car purchase has become increasingly popular, especially as car prices continue to rise. At Upper Valley Auto Mart, we offer a variety of auto financing options tailored to your budget and needs. Here's why financing could be a smart move:

Pros of Financing with an Auto Loan:

Preserve Cash Flow

One of the most significant advantages of financing is that it allows you to keep your cash in the bank. By putting down a smaller amount upfront and financing the rest, you maintain liquidity for other investments, emergencies, or expenses.Build Credit History

Regular, on-time payments on an auto loan can help build or improve your credit score. This can benefit you in the long run, making it easier to qualify for better interest rates on future loans, including mortgages and credit cards.Access to Better Vehicles

Financing gives you the flexibility to purchase a higher-end model or a newer vehicle than you might afford with cash. This can mean better safety features, improved fuel efficiency, or simply a more enjoyable driving experience.Potential for Dealer Incentives

Dealerships sometimes receive a small fee from lenders for helping to facilitate the loan. This gives us an incentive to offer competitive pricing or special financing deals to customers. At Central Vermont Auto Mart, we work with multiple lenders to find you the best used car loan options.Flexible Auto Loan Options

We offer a variety of auto financing plans to suit different budgets and needs. Whether you have excellent credit or are rebuilding your credit, our finance team is here to help you find a solution that works.

Cons of Financing with an Auto Loan:

Interest Costs

The downside of financing is that you'll end up paying more than the car's purchase price due to interest charges. However, with competitive rates available, the cost of financing might be lower than the potential gains from investing your savings elsewhere.Monthly Obligations

Financing means committing to monthly payments for several years. It's essential to budget accordingly and ensure you can comfortably make these payments along with other financial obligations.Potential for Negative Equity

Since cars depreciate, there's a risk of owing more than the car is worth if it loses value faster than you pay down the loan. This is known as being "upside down" on a loan. Choosing a vehicle with a high resale value and making a reasonable down payment can help minimize this risk.

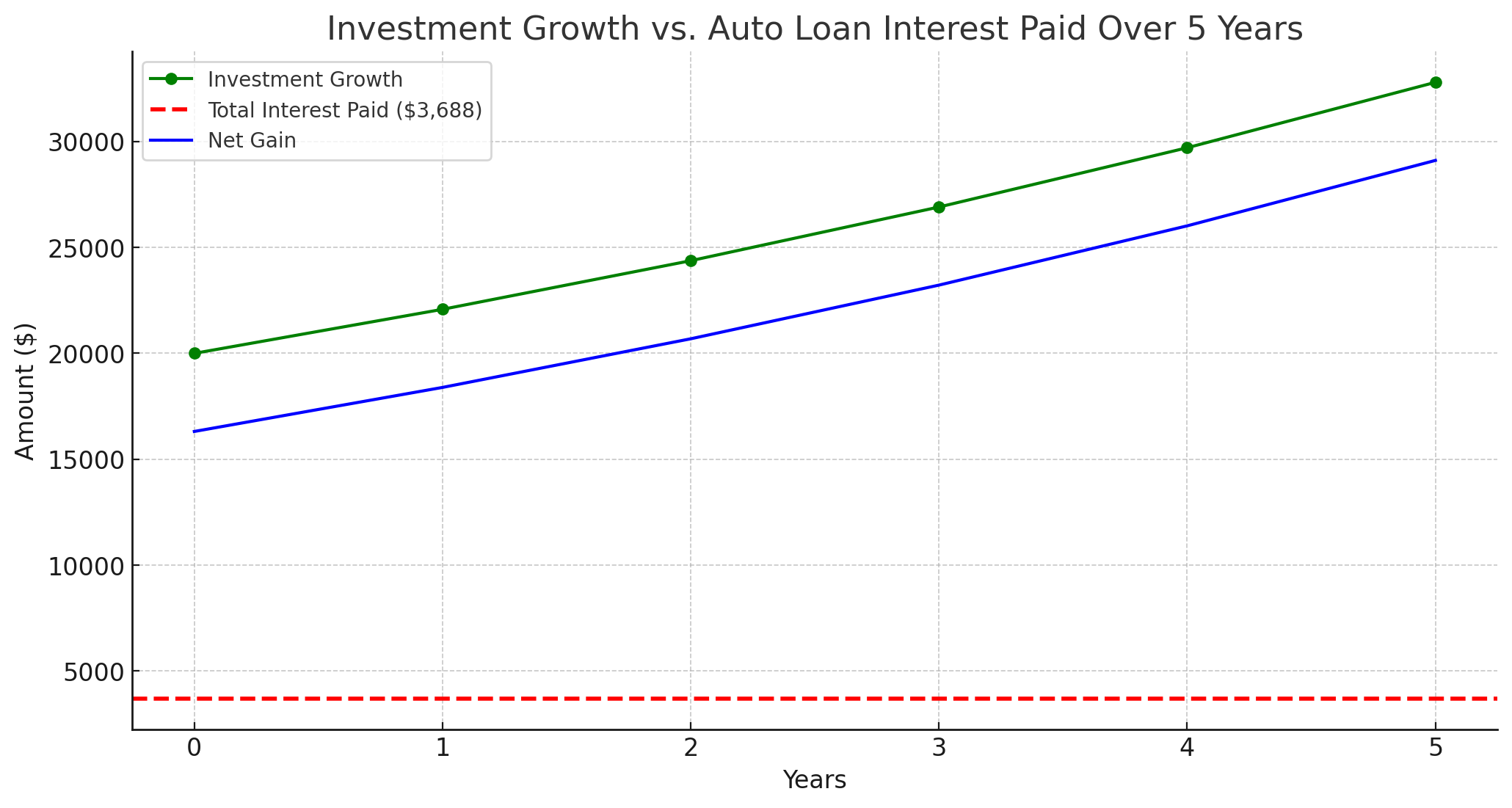

Why Financing Might Be the Right Choice: An Investment Example

- Initial investment/Purchase Price of Used Car: $20,000

- Average DJIA Annual Return (Past 10 Years): 10.4%

- Investment Period: 5 years

- Auto Loan Amount: $20,000

- Loan Term: 5 Years

- Loan Interest Rate: 6.87%

- Estimated Value of Car after 5 years: $6,200

Results:

- Total Investment Value After 5 Years: $32,800.11

- Total Interest Paid over 5 Year Auto Loan: $3,688.91

This example uses estimates to provide a simplified perspective of the costs and benefits, but it does not account for other factors that could affect the net gain, such as investing the amount of the monthly payment into a savings vehicle. It important to take the time to analyze your situation and use assumptions you find reasonable. ^

Conclusion: Which Option is Right for You?

Both paying cash and financing with an auto loan have their benefits and drawbacks. If you prefer no monthly payments and can afford to pay outright without affecting your financial security, paying cash might be the way to go. However, if you want to preserve your cash flow, build credit, and take advantage of competitive interest rates, financing could be the smarter choice.

At Upper Valley Auto Mart, we're committed to helping you make an informed decision. Our auto financing options provide flexibility, and our team is here to answer any questions you might have. Whether you're looking for used cars in White River Jct., Vermont or West Lebanon, NH, or exploring affordable used car loans, we're here to help.

Drive smarter, save smarter - explore your options today!

Published 02/26/2025

Published 02/26/2025